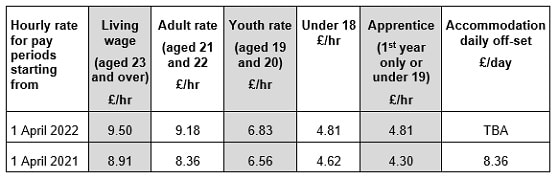

The Low Pay Commission recommended that the NLW rate should rise to £9.42 per hour, but the Government has gone further and announced it will increase the NLW to £9.50 per hour for pay periods starting on and after 1 April 2022. The full rates as announced are set out below.

The apprentice rate has risen significantly by 11.9% to £4.81, and has been aligned with the rate for those employees aged 16 and 17. This may help to relieve the NMW apprentice trap we explained on 26 August, which caught out employers who have apprenticeships lasting more than one year for younger employees.

The employer must have an actual apprenticeship agreement in place with the employee to pay the apprenticeship rate. Employers who take on apprentices before midnight on 31 January 2022 can claim a £3,000 incentive for each apprentice hired.

Anyone employed through the Kickstart scheme has to be paid the NMW relevant to their age. Employers must apply for funding to pay employees on the Kickstart before 17 December 2021, but the scheme has been extended so the start date for those new employees can be anytime up to 31 March 2022.

Employers still need to keep a sharp eye on the birthdays of their employees to ensure any rise in wage rate is implemented for the pay period that begins after the individual moves into a different age category – see table.

Written by the Tax Advice Network