The 1.25% increases in the rates of both Class 1 and Class 4 NIC were announced back in September, as we outlined on 16 September 2021.

This is a temporary increase in NIC, which will be replaced by the Health and Social Care Levy at 1.25% from 6 April 2023, but that levy has a slightly wider base as it will apply to those who are still working and aged over state retirement age.

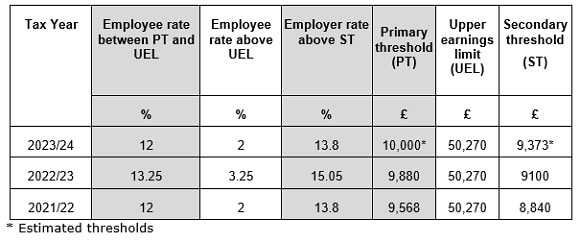

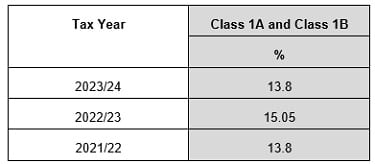

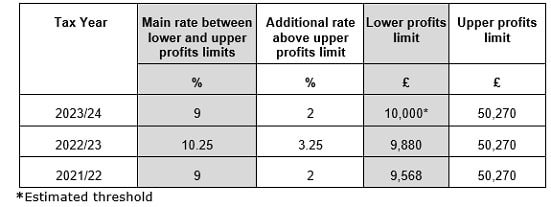

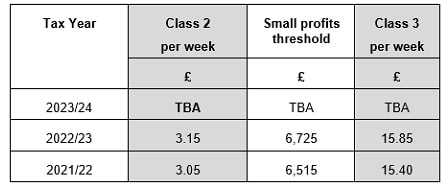

In the meantime, the Health and Social Care Levy Act 2021 provides for transitional increases in NIC rates to apply only for 2022/23, as detailed in these tables:

NIC Class 1

Class 1A and Class 1B

NIC Class 4

Classes 2 and 3

The Employment Allowance (confirmed at £4,000 for 2022/23) can cover employer’s Class 1 NIC, but not Class 1A or Class 1B. It is still not clear whether the Employment Allowance will cover the Health and Social Care Levy from April 2023

Written by the Tax Advice Network