Scottish tax rates

The Budget for Scotland was presented to the Scottish Parliament on 14 December. It includes a radical proposal to change to income tax rates and bands for Scottish taxpayers. If these proposals are passed as suggested they will produce some eye-watering marginal tax rates for 2018/19.

The Scottish income tax rates and bands only apply to income which is not savings or dividend income, so the tax due on other categories of income must be calculated using rates and bands which apply in the rest of the UK.

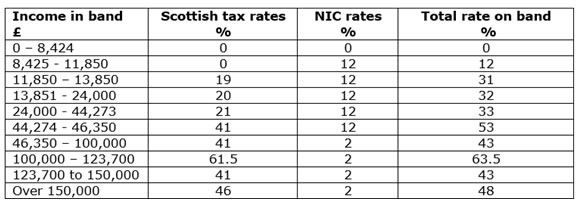

The following table shows the tax rates and bands for employment income for a person under state pension age, before deduction of the personal allowance of £11,850 for 2018/19. The NIC rates will be different for self-employed individuals, and NIC is not payable by those over state pension age.

The tax rate on income between £100,000 and £123,700 is an effective rate not a statutory rate. It arises because the personal allowance is withdrawn by £1 for every £2 of additional income in that band.

Taxpayers who plan to take a lump sum from their pensions must be particularly careful not to push their income into a band where it may be taxed at 53% or 63.5%.

Written by the Tax Advice Network