The Welsh Government was granted powers to raise taxes back in 2014. That was so long ago that we had forgotten that they were actually going to use those powers to impose Welsh versions of SDLT and landfill tax.

These new Welsh land taxes will apply from 1 April 2018, as detailed below. The Welsh Government also has the power to vary the rates of income tax paid by Welsh taxpayers from 1 April 2019. There has been no indication of how those income tax powers will be used as yet, but we will keep you informed when we hear something.

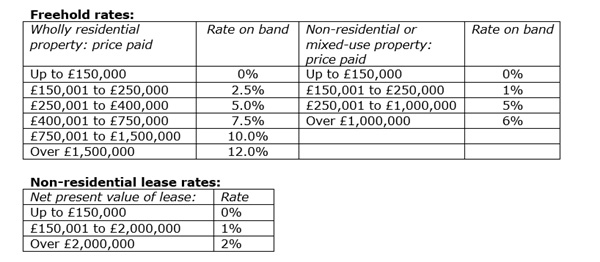

Land transaction tax

This tax will apply to properties located in Wales for which the completion date of the contract to sell or lease is on or after 1 April 2018. The tax is calculated in the same fashion as SDLT, with the relevant percentage applied to the amount of consideration which falls in each band. Note the bands are quite different to those which apply for SDLT or LBTT in Scotland.

The 3% supplement that applies to purchases of second homes from 1 April 2016 in the rest of the UK, will continue to apply in Wales. However, the rules under which that 3% supplement will apply will be slightly different to those rules for the 3% supplement in England & Northern Ireland, and different again to the separate rules for the LBTT supplement on Scottish second homes.

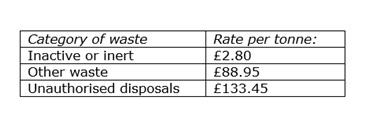

Landfill disposal tax

This tax applies to the disposal of waste in licenced sites in Wales made on and after 1 April 2018. The rates are in line with landfill tax rates in England to prevent waste from being moved across the border to avoid tax. There is a penal rate for unauthorised disposals which doesn’t currently apply in England, but the UK Government has proposed such a rate.

Landfill disposal tax 2018/19

For further details please contact DFC Accountants in Cardiff, Wales.

For further details please contact DFC Accountants in Cardiff, Wales.