Welcome to our monthly newswire. We hope you enjoy reading this newsletter and find it useful. Please contact us if you would like to discuss any matters further.

ELECTION ON 8TH JUNE – WHAT’S IN THE MANIFESTOS?

The decision to call a snap General election on 8th June caught many of us by surprise. The various political parties have been rushing out their manifestos making all sorts of promises if elected. These documents are becoming increasingly important. Bringing in measures contrary to a manifesto, like the increase in Class 4 National Insurance Contributions (NICs) from 9% to 10% can result in embarrassing U-turns!

The opinion polls suggest a significant Conservative Party majority so can we ignore the tax announcements by the other parties? Well the polls were wrong in 2015 and the Brexit referendum, and no-one expected Donald Trump would be elected President.

WHAT WOULD LABOUR DO IF ELECTED?

If elected Labour have pledged to re-nationalise the railways and Royal Mail and bring some of the power and water industries into State ownership. They have also promised to bring an end to student loans. These and other measures will be very expensive and will require big increases in taxation and borrowing.

Key tax raising measures include increasing the corporation tax rate to 26% and income tax to 50% for Individuals with income in excess of £123,000.

The threshold for paying the current 45% top rate would also be reduced from the current £150,000 limit to just £80,000 supposedly increasing the tax paid by the top 5% of the population.

Labour would also increase the rates of capital gains tax and abolish the new additional inheritance tax nil band for passing on the family home.

LIBERAL DEMOCRAT TAX MEASURES

The Liberal Democrats are unlikely to win a majority in the General Election but may hold the balance of power. Like the Labour party they would increase corporation tax but only to 20% as they appreciate the importance of keeping the UK corporate tax rate low to encourage companies to remain in the UK, particularly post Brexit. The Liberals have also pledged to increase income tax rates by 1% to fund social care.

CONSERVATIVE PARTY TAX POLICIES

There is much emphasis in the Manifesto on “Strong and Stable” leadership by Mrs May but not much on taxation.

The Conservative Party continues with its commitment to keep the UK corporate tax rate at the lowest rate in the G20 major trading nations. Like the Lib Dems they appreciate how important this will be when we leave the European Union to continue to attract overseas investment in the UK. The Conservatives are also committed to continuing to encourage innovation.

Although not a tax, paying for care home fees has become a significant cost for many families. The Conservative Party proposes to increase the asset threshold above which individual is required to pay towards their own care from £23,250 to £100,000. This will mean that this amount would then be available to be passed to future generations of the family. For many families paying for social care has become a bigger issue than inheritance tax. Note that the value of the family home is taken into consideration for the purposes of this asset test. Will this last following pressure from traditional Conservative voters.

There will be further anti-avoidance measures to close the “tax gap” – the gap between the tax that should be collected and that is actually collected. This will include measures to combat false self-employment in the so-called “gig” economy which will not only strengthen such workers’ rights but also ensure that the correct amount of income tax and national Insurance is paid.

Although there will be no increase in the main rate of VAT there is no mention this time about locking in the rates of income tax and National Insurance Contributions.

SNAP ELECTION MEANS SHORTER FINANCE ACT PASSED

The original Finance Bill published after the Spring Budget ran to nearly 700 pages. As a result of the announcement of the General Election on 8th June a significantly shorter Finance Bill was passed with many of the more detailed and more controversial measures being deferred to a later Bill. Whether those measures will reappear after the election will depend upon who wins on 8th June.

Among the tax changes that didn’t make the cut was the legislation to introduce Making Tax Digital, all of the corporation tax changes such as those affecting company losses and the changes affecting non-domiciled Individuals.

However the changes affecting workers supplying their services to the public sector via their own personal service company were enacted with effect from 6 April 2017.

Many hope that the deferral of the Making Tax Digital legislation to the next Finance Bill may mean that the planned start date in April 2018 will also be deferred. There will certainly be more time for proper debate of the proposed changes and the Treasury Select committee still has a number of reservations about the speedy implementation of such a significant change to the UK tax system. Watch this space.

HMRC COMPUTER ISN’T ALWAYS CORRECT

HM Revenue and Customs have acknowledged that their software and some commercial software used by accountants doesn’t always come up with the right amount of tax payable! You may have seen this reported in some newspapers such as the Daily Telegraph.

This arises because the tax system of different income tax personal allowances, dividend allowances, savings rates has become more complicated rather than getting simpler!

These anomalies only arise in certain limited circumstances depending on the combination of dividends, interest and other income and we can assure you that we will check that our software calculates the correct amount of your tax. We will ensure that where the HMRC computer system comes up with a different figure any anomalies are resolved.

STAMP DUTY ON SECOND HOMES

Since 1 April 2016 there has been a 3% supplementary Stamp Duty Land Tax (SDLT) charge payable on the purchase of second and subsequent residential properties costing more than £40,000. This was clearly aimed at buy-to-let investors as well as those buying second homes.

Note that this additional 3% charge does not apply where the main residence is replaced.

Where the new main residence is bought before the old home is sold the 3% still has to be paid but is refunded if the old home is sold within 36 months.

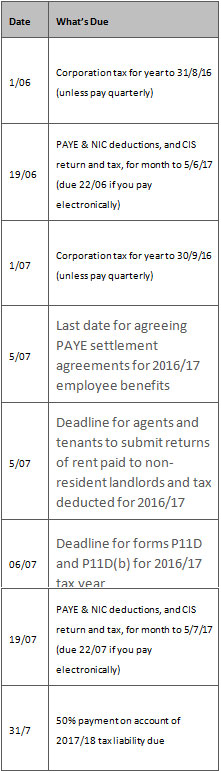

DIARY OF MAIN TAX EVENTS

JUNE/JULY 2017

For more information contact DFC Accountants in Cardiff