We outlined the rules for new cash basis for unincorporated property businesses in our newsletter 2 February 2017. The draft legislation was only published on 31 January, but those new rules will apply by default to individual landlords from 6 April 2017, unless the landlord opts out.

We have now examined the draft legislation in greater detail, and have found a further restriction for interest and finance charges. Where the property is residential lettings, other than furnished holiday accommodation, this cash-basis restriction applies before and in addition to the block on 25% of finance charges for 2017/18 (moving to 100% form 2020/21).

It applies where the value of the loans outstanding (L) exceeds the value of the let properties (V) at the end of the tax year. It will catch landlords who have re-mortgaged since starting the property business.

V = market value of the properties when first let, plus the cost of any capital improvements added to those properties since that date.

L = the property business portion of all loans.

Example

Pete lets residential properties which were worth £500,000 (V) when first let. He has re-mortgaged so his outstanding loans are now £525,000 (L). His gross rents are £80,000 and finance costs are £42,000. If Pete doesn’t opt out of the cash basis for 2017/18 the deduction for loan interest is restricted using the fraction V/ L

500,000 x 42,000 = £40,000

525,000

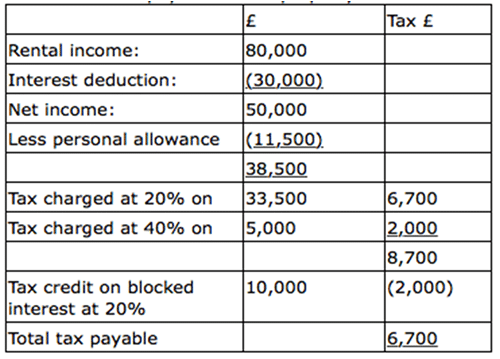

As Pete’s properties are residential, he must also restrict his finance costs by 25% in 2017/18, which means he can only deduct finance costs including interest of £30,000 (75% x 40,000).

The income tax payable on his property business for 2017/18 is calculated as:

Written by the Tax Advice Network