To balance the increase in NIC payable on salaries and self-employed profits, the tax payable by individuals on dividends will also increase by 1.25 percentage points from 6 April 2022, as we outlined on 9 September 2021.

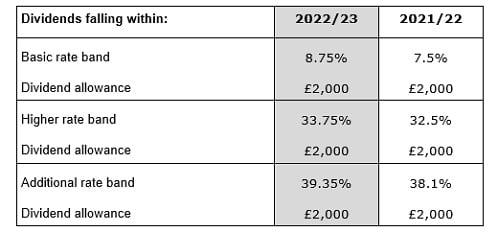

However, this dividend tax increase is permanent and not temporary. It will apply to all dividends taken from all companies, where the total dividend income exceeds the taxpayer’s dividend allowance which has been held at £2,000 for 2002/23, see table.

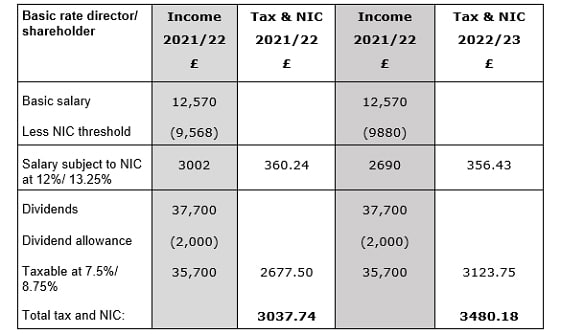

This tax increase is significant. For a director of a personal service company, who takes a salary of £12,570 and dividends of £37,700 per year, his tax will increase by £442.44 in 2022/23, calculated as follows:

That’s a tax increase of nearly 14.5% in one year. The rate of corporation tax charged on overdrawn directors’ loan accounts (s 455 charge), is currently set at 32.5% to match the tax on dividends in the higher rate band. It is likely that this rate will also increase to 33.75% from 6 April 2022, but this wasn’t mentioned in the Budget announcements.

Written by the Tax Advice Network