The National Minimum Wage (NMW) and the National Living Wage (NLW) rates rise for pay periods starting on or after 1 April 2021, but this year there is also a change in the age qualification for the top two bands.

The NLW rate now applies to workers aged 23 and over, which previously applied only for workers age 25 and older. This means the next band down now applies to workers aged 21 and 22, not 21 to 24 inclusive. This represents a significant cost increase for employers who employ workers aged 23 and 24.

Where employers have a salary sacrifice scheme in place, perhaps for employer provided bicycles, they need to check there is still the headroom in the wages calculation, after the salary reduction has been taken, to leave at least the NLW in place for those younger workers.

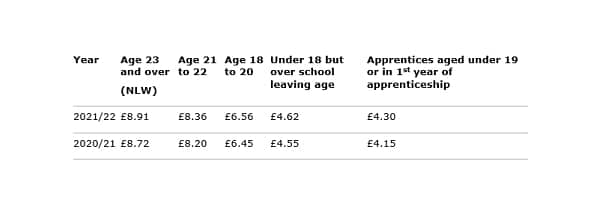

The current NLW and NMW rates are:

Employers must also retain all NMW and NLW records for six years instead of three years from April 2021.

Written by the Tax Advice Network