The annual tax on enveloped dwellings (ATED) must be paid every year by corporate owners of residential properties in the UK, where the property is worth over £500,000, and one of the reliefs or exemptions has not been claimed for the property.

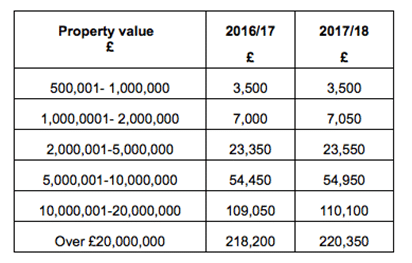

The new ATED rates for the chargeable year beginning 1 April 2017 have just been announced, as set out below. The charge for this period is due to be paid by 30 April 2017, which is also the due date for the ATED return. The details of each property for which an ATED charge is due must be submitted on a separate ATED return: one property per return.

If the property qualifies for one of an ATED relief, it can be included on an ATED relief declaration return (also due in by 30 April 2017). There is a different relief declaration form for each type of relief, but more than one property can be included on each relief declaration.

We can submit the ATED returns and ATED relief declarations on behalf of our client, online or on paper. But these online forms can’t be submitted until 1 April 2017, where they relate to the 2017/18 chargeable period. This means you have just 30 days to submit all the ATED returns for our clients.

Remember “corporate owner” for ATED includes; any company wherever it is registered, a partnership where one or more of the partners is a company, or a collective investment scheme, such as a unit trust. Even if the property is only partly owned by a corporate, the ATED charge applies.

Written by the Tax Advice Network