The national minimum wage (NMW) is increasing again, but this time the new rates take effect from 1 April 2017 instead of 1 October 2017. You need to be aware that for younger employees this will be the second compulsory pay rise in six months.

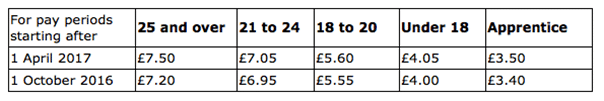

The new hourly rates are:

The rate for workers aged 25 and older is referred to as the national living wage (NLW), which was introduced on 1 April 2016 at an initial rate of £7.20. In future, increases of the NMW and NLW will take effect from 1 April each year.

It is crucial that employers know exactly who should receive which level of minimum wage, and how the amount per hour should be calculated. Any underpayment of NMW or NLW can attract a penalty of up to 200% of the underpaid amount, up to £20,000 per worker, with a minimum penalty of £100 per worker.

Employers who underpay NMW or NLW can be publicly named, if the amount due exceeds £100, and they have been issued with a notice of underpayment by HMRC. The publication of the employer’s details will not explain that the underpayment was due to an innocent mistake in the calculations – even if it was.

Written by the Tax Advice Network

Leave a Reply