Welcome to our latest monthly tax newswire. We hope you enjoy reading this newsletter and find it useful. Contact us if you wish to discuss any issues further.

DOES YOUR ACCOUNTS SYSTEM COMPLY WITH MTD FOR VAT?

Making Tax Digital (MTD) for VAT is scheduled to start in April 2019 which means that your VAT information needs to be submitted to HMRC digitally.

On 18 December 2017, HMRC published draft legislation together with examples of how the business account records might link with the HMRC computer in order to comply with MTD for VAT. The legislation specifies that “functional compatible software” must be used to record and preserve prescribed VAT related data.

What are Digital records?

“Functional compatible software” must be used to calculate the VAT due, report the VAT figures (as per the current VAT return) to HMRC, and to receive information back from HMRC.

VAT related data for each sale and purchase made by the business includes the time of the supply, the value and the rate of VAT charged, or in the case of purchases, the amount of input VAT allowed.

There is no requirement in the draft regulations that the electronic recording of this data must be done at the time the supply is made, or when the purchase is received. As long as the data is recorded electronically by the earlier of the date that the VAT return must be submitted, or is actually submitted.

Digital Links in the Trail

The business can use more than one piece of software to keep its digital records, but those separate software programs must be “digitally linked”. HMRC provides examples of what it means by digitally linked in the draft notice.

One example is a business which uses one piece of accounting software to record all sales and purchases, this software then calculates the return and submits it to HMRC. As well as the records in the accounting software the business uses a spreadsheet to keep track of a fleet of cars and work out its road fuel scale charges. The draft guidance suggests that the business can type the adjustment into its accounting software.

We can of course work with you to make sure that your accounting systems will comply with the new VAT rules before they start in 2019. Note that MTD for VAT will not be mandatory where turnover is below the VAT registration limit, currently £85,000 per annum.

DID YOU GET A BIG TAX BILL AND NOW WANT SOME BACK?

Many of you will have just paid your 2016/17 tax bill before the 31 January 2018 deadline, and some of you will also have paid 50% of next year’s tax on account. Here are a couple of tax planning ideas that can help you obtain a tax refund.

Invest in EIS or Seed EIS qualifying companies

Before 6 April 2018, individuals may invest in companies that qualify under the Enterprise Investment Scheme (EIS) and treat that investment as having been made in 2016/17. The tax relief is 30% of the amount invested. So a £20,000 investment can reduce the 2016/17 tax liability by £6,000. Investing in a Seed EIS qualifying company is even better as there is a 50% tax relief. Such companies tend to be riskier than EIS qualifying companies. You should therefore obtain specialist advice from an IFA if you are considering such investments.

Investing in an EIS qualifying company can also enable you to defer capital gains tax. In order to do so you must reinvest the amount of the gain within the 3 years following the date of the disposal giving rise to the gain. (The investment could also be within 12 months prior to the disposal).

Increase your Pension Savings before 6 April 2018 to reduce payments on account

Unfortunately investing more in your pension now will not reduce your 2016/17 tax liability, however if you invest before 6 April 2018 that payment can be taken into consideration in computing your 2017/18 liability and hence you might be able to claim to reduce your payments on account, if you make them. The maximum pension contribution is generally £40,000 each tax year, although this depends on your earnings. It is also possible to add to this any unused relief brought forward from the previous three tax years.

EXCEEDING THE ANNUAL PENSION ALLOWANCE

If your pension savings exceed the annual pension input limit (generally £40,000) then there is an annual allowance charge. The effect of the annual allowance charge is to reduce tax relief on any pension saving over the annual allowance.

The annual allowance charge is not at a fixed rate but will depend on how much taxable income an individual has and the amount of their pension saving in excess of the annual allowance. Hence for a higher rate taxpayer the charge would be 40% on the excess over the annual pension allowance. Note that annual pension input includes any contributions made by the employer and it may be those contributions that trigger the charge.

You can ask your pension provider to pay HMRC out of your pension pot if you’ve gone over your annual allowance and the tax is more than £2,000. You must tell your pension provider before 31 July if you want them to pay the tax charge for the previous tax year.

ADVANTAGES OF FURNISHED HOLIDAY LETTINGS

Many of the recent changes in the taxation of buy to let rental businesses do not apply to property businesses that qualify as furnished holiday lettings (FHL).

In particular the restriction on deductibility of finance costs that started to apply from 2016/17 does not apply to furnished holiday lettings. It may be worth considering investing in such properties to take advantage of a number of other generous tax breaks.

Tax reliefs that apply to furnished holiday letting businesses

Furnished holiday letting businesses are treated like a trading business for many, but not all tax purposes.

- Capital allowances are available on furniture and equipment such as cookers, washing machines, beds.

- Profits count as earned income for pension purposes

- CGT entrepreneurs’ relief applies on disposal of the holiday rental business

- Capital gains may be rolled over into FHL property

- CGT gift holdover relief available on the gift of the rental business.

Note that inheritance tax business property relief does not generally apply on the transfer of FHL property businesses.

What is a furnished holiday letting (FHL) businesses?

There are strict rules for a property rental business to qualify as furnished holiday lettings. The most important conditions are:

- Property must be situated in the UK or European Economic Area (EEA)

- Furnished and let on a commercial basis Available for letting for 210 days a year

- Actually let for 105 days a year

- Not normally let for more than 31 consecutive days to the same person (i.e. short lets)

- In other words lettings in excess of 31 days are excluded from the 105 day test as are periods let to family and friends on a non-commercial basis

Averaging Election

For individual landlords the 210 day and 105 day tests apply to the tax year or the first 12 months on commencement of the rental business.

If the 105 day test is not met it is possible to make a “pooling” or averaging election where several FHL properties are rented out in the tax year. You can elect to apply the letting condition to the average rate of occupancy for all the properties you let as FHLs. There are separate elections or pools of UK and EEA properties.

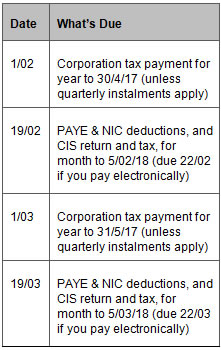

DIARY OF MAIN TAX EVENTS

FEBRUARY/MARCH 2018