There is a dedicated unit within HMRC that chases down employers who don’t abide by every letter of the national minimum wage regulations. If errors are found, the employer can face penalties of up to 200% of the underpaid amount, and be included on a public list of defaulting employers.

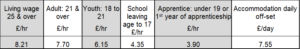

Please be aware of the new NMW rates that come into force for pay periods beginning on and after 1 April 2019:

Which rate is payable is dependant upon the employee’s age, so its essential that the correct birth date is recorded for each employee, and the ages of the employees are checked before each payroll is run.

The other NMW elephant trap for employers occurs when they make deductions from the employee’s gross or net wages, which takes the amount paid per hour worked down below the NMW rate. This rule applies even if the employee has agreed to the deduction, such as for a savings scheme.

Where lower paid employees take part in salary sacrifice schemes under which they surrender a fixed amount rather than a percentage of pay, and they also switch from full-time to part-time work, it is easy for the take-home pay to accidentally slip below the NMW rate. This can happen where the tax-free amount for childcare vouchers is sacrificed.

Written by the Tax Advice Network