Scottish tax

Derek Mackay presented his Budget to the Scottish Parliament on 12 December. In contrast to Philip Hammond’s Budget on 29 October, Mackay has chosen to freeze the higher rate tax threshold for 2019/20. This means Scottish taxpayers will pay 41% tax from £43,430, rather than 40% tax above £50,000 as will apply in the rest of the UK.

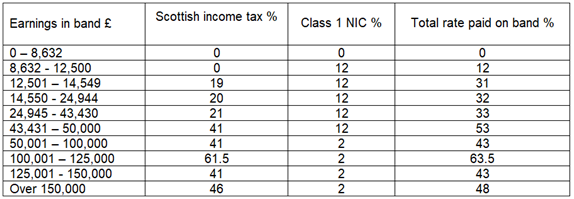

Scottish taxpayers are broadly those whose main home is in Scotland. However, they only pay Scottish income tax on non-savings and non-dividend income. Tax on dividends, savings and gains must be calculated using tax rates and bands which apply in the rest of the UK. The following table shows the effective total tax and NIC rates applicable to employment income for 2019/20, before deduction of the personal allowance of £12,500. Self-employment attracts lower NIC, those over state pension age pay no NIC at all.

Scottish taxpayers with earnings between £43,430 and £50,000 fall into the bear trap of 53%, and you need to watch out for this when recommending clients take bonuses, or other employment benefits in 2019/20. The marginal tax rate of 63.5% between £100,001 and £123,700, arises due to the tapering away of the personal allowance above £100,000.

Welsh tax

Welsh income tax also comes into effect on 6 April 2019, replacing 10 percentage points in each tax band with 10% rate of Welsh income tax. The Welsh government has decided not to fiddle with the income tax thresholds for 2019/20, so Welsh taxpayers will see no change to their tax liabilities, other than a new PAYE tax code beginning with C. Written by the Tax Advice Network