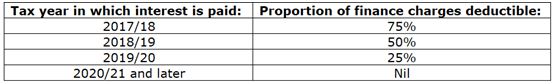

Back in 2016 we will have advised personal clients about the new rules for deducting interest from residential property income, which were due to come into effect on 6 April 2017. Some clients will have paid attention and taken action to restructure their property businesses, others…not so much. The proportion of finance and interest charges which can be deducted from residential property income is gradually being reduced to nil as follows:

The landlord will have a tax credit (20% x blocked interest) that reduces his income tax bill. This 20% rate applies irrespective the landlord’s actual marginal tax rate.

Some clients will get a nasty shock when they see their tax bill for 2017/18 is much higher than what they paid on a similar level of profit for 2016/17. You need to give them the bad news that their tax bill for 2018/19 may be even higher.

There are four ways out of this bind, but they all require careful thought around the knock-on tax implications;

- Sell some residential property and reduce the level of debt for the remaining property business.

- Sell all residential property and reinvest in commercial property.

- Let the property in such a fashion so it qualifies as furnished holiday lets for tax purposes.

- Transfer the let properties to a company controlled by the taxpayer.

Our tax experts can help advise you on restructuring, but time is running out for residential property businesses which are supported by large mortgages.

Some landlords have no debt in their property businesses, and they are not affected by the interest and finance restrictions.

However, individual landlords (of all types of property), should draw up their accounts for 2017/18 using the cash basis for landlords (different to the cash basis for trading businesses). Where the total receipts of the property business exceed £150,000 for the tax year, the cash basis should not be used, and GAAP accounting can be used instead. Any individual landlord can elect to use GAAP accounting rather than the cash basis, by ticking a box on the 2017/18 tax return, so watch out for that. Written by the Tax Advice Network