In our newsletter on 22 December 2016 we explained how the income tax bands for Scottish taxpayers will differ from those applicable to taxpayers in the rest of the UK, from 6 April 2017. However, those tax bands have been revised again.

The Scottish National Party (SNP) does not have an absolute majority in the Scottish Parliament, so it must secure the cooperation of other parties to pass its 2017/18 Budget. One of the concessions demanded by the Green Party is to freeze the threshold of the 40% tax band at £43,000.

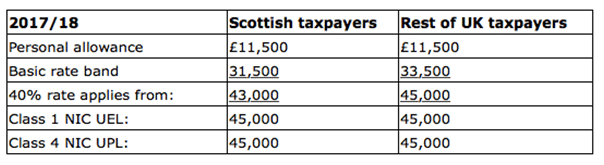

This policy has now been written into the Budget proposals which are being debated at Holyrood. If the Scottish Budget is passed as currently proposed the basic and higher rate tax bands for earned income will be:

These Scottish tax bands do not apply for capital gains, savings income or dividend income. This means a parallel tax computation will have to be performed for all Scottish taxpayers to work out their entitlement to the savings allowance, their dividend tax rate or CGT rate.

To complicate matters even further HMRC has issued the definitive leaflet (P9X) which explains what tax codes to use from 6 April 2017, and it includes the wrong tax bands for Scottish taxpayers.

Written by the Tax Advice Network