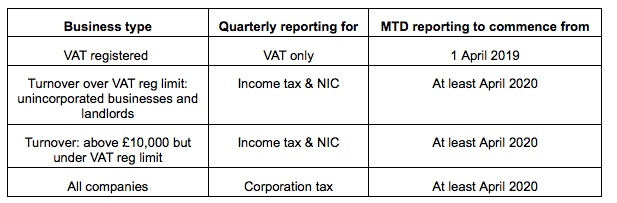

Many tax professionals have always believed that the timetable for introducing MTD for businesses was too ambitious. When the project was delayed by the EU referendum and the General Election, it became clear that hitting the target commencement dates would be impossible, so a revised timetable has been proposed:

Mel Stride, the new Minister in charge of HMRC, made it clear that the scope of MTD quarterly reporting will not be extended beyond VAT until “the system has been shown to work well”. This implies that the April 2020 start date is an aspiration; compulsory MTD reporting for taxes other than VAT may commence much later.

The reporting of figures for VAT purposes under MTD will also only be compulsory for businesses who are required to be VAT registered. Those businesses who have registered for VAT on a voluntary basis, as their turnover is below VAT registration limit, won’t have to use the MTD system from April 2019, but can choose to do so. Businesses who make annual VAT returns won’t be forced to do quarterly MTD reporting for VAT.

It is clear that MTD for income tax and NIC will be voluntary for some years, although compulsion is still a possibility in the future. The Government has said that all businesses will be given a two-year adaption phase before keeping digital records becomes a requirement.

We hope that HMRC will release some new consultation papers to explain how MTD will work for; partnerships, corporations, and businesses who use the various VAT schemes such as TOMS. DFC Accountants will keep you informed when new information appears.