A lifetime ISA (LISA) can be opened from 6 April 2017 by individuals who are resident in the UK, or crown servants serving overseas (including in the armed forces), or a spouse/ civil partner of such a civil servant. The ISA applicant must also be aged at least 18 and under 40 years.

The maximum which the saver can contribute into a LISA in 2017/18 is £4,000, which forms part of the £20,000 total permitted amount of ISA contributions for this tax year. The main attraction of a LISA is that the Government will add a 25% bonus to the savings contributed in each tax year, subject to a maximum of £1,000.

However, there is a 25% withdrawal charge when the funds are taken from the LISA unless one of the following conditions applies:

• the funds are used towards the purchase of the saver’s first home (maximum value of home is £450,000);

• the saver is aged 60 or older when the withdrawal is made, or

• the saver is terminally ill, or has died.

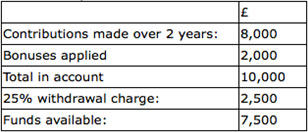

The withdrawal charge is payable to HMRC and is calculated as illustrated in this example:

The withdrawal charge claws-back the Government bonus, plus 6.25%. There may also be an administration charge applied by the LISA provider. Note the withdrawal charge also applies if the funds are transferred to another type of ISA.

Saving through an LISA may be a useful way to make additional pension savings for those who have utilised all of their £40,000 pensions annual allowance. The savings withdrawn after the age of 59 are not taxable, which includes interest and bonuses accumulated in the LISA. However, the LISA account must be opened before the saver reaches age 40.

Parents or grandparents can pay into their child’s or grandchild’s LISA, without the income being taxed on them, as the owner of the ISA must be an adult aged at least 18. If the contributions are made as normal expenditure out of the payer’s surplus income, those gifts into the LISA will be free of IHT.

For more information contact DFC Accountants in Cardiff